by Dinah A. Koehler, PhD

After winter Storm Blair blew through the Midwest this January, businesses in Kansas, Kentucky, West Virginia, Virginia, and Arkansas suffered significant disruption. Over 86% of businesses affected by the storm in these states reported weather-related monetary losses to the Census Bureau’s BTOS survey. In Nebraska 88% of businesses exposed to winter storms reported monetary losses.

CSO Partner’s data capabilities allow for “nowcasting” of a range of climate risks, including business disruption risks, increases in insurance premiums, worker health and productivity losses, and other economic impacts of extreme weather. We put these risks into the local context of a facility, which relies on functioning infrastructure to operate. The analysis reveals which locations are at greatest risk of weather-related disruptions and will require resilience measures to maintain operations during and after an extreme weather event.

For example, snow and ice storms from January to March of 2025 caused monetary losses to over 80% of exposed businesses in 21 states, ranging from Montana across the central states to Massachusetts. After 18 tornados touched down in Mississippi April 2025, 62% of affected businesses reported monetary losses. Residents and businesses in affected areas are still waiting for FEMA disaster relief two months later. Last year, over 90% of businesses in Florida that were affected by Hurricane Milton reported monetary losses. On the west coast, up to 70% of surveyed businesses in California reported monetary losses due to wildfire exposure. As the BTOS survey shows, local businesses also suffer.

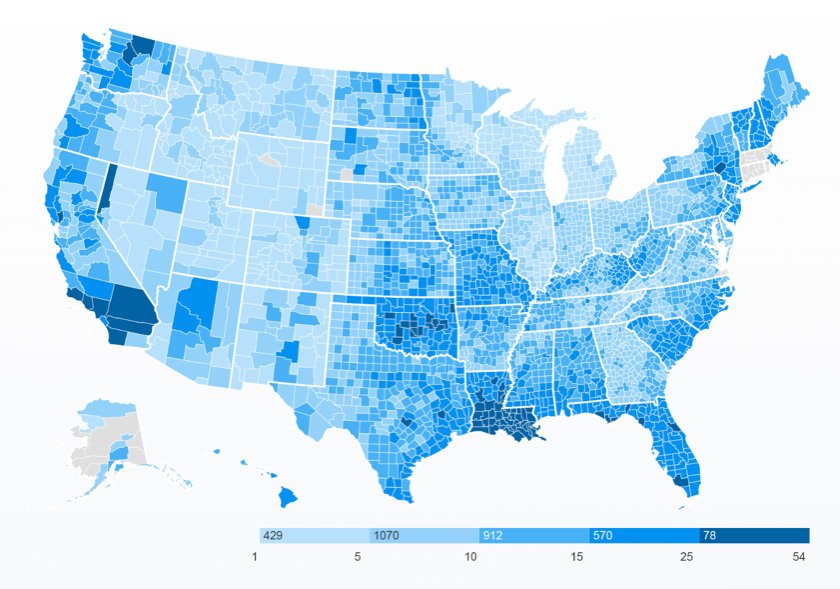

According to the National Association of Counties (NAC), the average wait time for disaster relief payments is 1-3 years. In the meantime, county and municipal governments must front the bills if they can.  Most do so by implementing austerity measures, short term loan financing, or bond issuance. The result is strained county coffers and communities that are limping along waiting for federal assistance. Counties with presidentially declared natural disasters (darker blue on this map) are concentrated in Southern Louisiana, Oklahoma, Southern California, Washington and Florida.

Most do so by implementing austerity measures, short term loan financing, or bond issuance. The result is strained county coffers and communities that are limping along waiting for federal assistance. Counties with presidentially declared natural disasters (darker blue on this map) are concentrated in Southern Louisiana, Oklahoma, Southern California, Washington and Florida.

Businesses rely on vibrant communities. Without a strong disaster preparedness plan they too will struggle to recover. FEMA disaster recovery assistance through the Small Business Administration can reduce the risk of bankruptcy by 13% and help put firms back on a solid footing compared with firms that did not receive disaster aid.

Any disruptions to FEMA will slow the rebuild process. Longer recovery periods mean more bankruptcies. For businesses in high-risk counties in the south and east of the Rockies that have historically relied heavily on FEMA funds, the need for climate resilience is a survival imperative.

Knowing your business risk exposures, whether to flood, wildfire, extreme heat, or supply chain interruption, is the first critical step to building resilience. Robust risk evaluation enables businesses to start building resilience through insurance, infrastructure upgrades, continuity planning, and partnerships. These resilience measures are not possible without a clear-eyed view of where you’re vulnerable and how your operations are exposed to a warming, more volatile climate.

Dinah Koehler has over 25 years of experience leading corporate environmental programs, developing ESG and impact measurement systems in the public and private sectors and advising international development banks and national governments on sustainability strategy. She holds a Science Doctorate in Environmental Science and Risk Assessment from Harvard School of Public Health and a Masters from The Fletcher School at Tufts University.

Dinah Koehler has over 25 years of experience leading corporate environmental programs, developing ESG and impact measurement systems in the public and private sectors and advising international development banks and national governments on sustainability strategy. She holds a Science Doctorate in Environmental Science and Risk Assessment from Harvard School of Public Health and a Masters from The Fletcher School at Tufts University.